Are hybrids the answer to loss in aftersales revenue? In the short term, at least, yes.

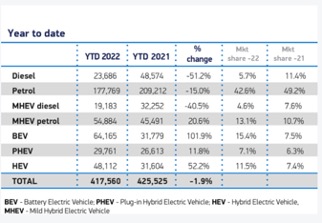

- With new car diesel sales dropping 50% YoY from 11.4% down to 5.7% market share – potential aftersales revenue losses could be substantial.

- However, with hybrids now making up 36% of all new car registrations, the service revenue generated from those sales will be welcome news for Aftersales teams.

Source: SMMT

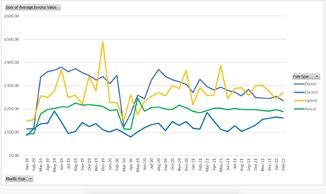

Analysis by Real Time Communications Data Science team has revealed the impact that fuel selection is having on typical service revenues. Income is set to fall in the future without changes in the aftersales proposition.

Average service invoice value for service work from 2019-2022 by fuel type:

- Diesel engines £289.84

- BEVs £127.25

- Hybrids – £268.27 (including MHEV, PHEV & HEV)

- Petrol – £191.88

The reduction in revenues from battery electric vehicles (BEV) that do not require a traditional vehicle service is significant. However, the revenues from hybrid cars could perhaps soften the decline and help aftersales reimagine their proposition.

Reflecting on the challenge, John Law, Technical Director REALinsights notes:

“The pain of the significant loss of new car sales will have a material impact on aftersales in the next few years; the increasing sales of BEVs will accentuate this trend. While redefining the aftersales model might be seen as something to do with the shift to fully electric, a broader approach including hybrids and attracting/retaining older petrol and diesel vehicles at the dealership is the right approach and it needs to start now to maintain aftersales revenue levels.”

The notable opportunity with hybrid cars is clear to see. Analysis by Real Time Communications demonstrates that hybrid vehicles can help keep revenue levels more consistent than first thought in the short to medium term. This year, service value has been rising for hybrids and currently exceeds £270 per service, which exceeds diesel revenues.

Source: Real Time Communications REALinsights data

In addition to this opportunity, John points to a five-point strategy; retailers should consider addressing the challenges ahead for aftersales and their crucial role in overhead absorption:

- Promote service plans with a focus on opening used car service plans.

- Consider the use of longer used vehicle warranties, with warranties proven to tie in customer loyalty.

- Target older used vehicle owners – retention and conquest.

- Optimise red and amber work in your eVHC checks and follow-up.

- Open new aftersales revenue opportunities, such as valeting.